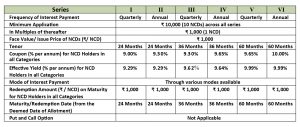

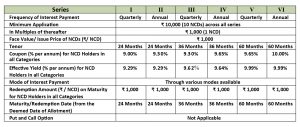

Arka Fincap Limited has come up with Secured, Rated, Listed, Redeemable Non-Convertible Debentures from December 07, 2023, to December 20, 2023. This is an attractive investment opportunity for investors as it has a credit rating of AA-/ Positive by CRISIL. Additionally, the company’s robust profile and impressive financial performance further enhance its attractiveness. This blog will provide details about the company, its public issue, and financial performance. Below are the details of the issue:

Issue Highlights

Issuer- Arka Fincap Limited

| Issuer Name | Arka Fincap Limited |

| Nature of Instrument | Secured Rated Listed Redeemable Non-Convertible Debentures |

| Rating | AA-/Positive by CRISIL |

| Seniority | Senior Secured |

| Face Value | Rs. 1,000 per NCD |

| Base Issue Size | Rs.150 crores |

| Option to retain oversubscription | Rs. 150 crores |

| Coupon | Up to 10.00% |

| Tenor | 24/36/60 months |

| Issue Date | December 07, 2023, to December 20, 2023 |

| Minimum Investment | Rs. 10,000 only |

Specific Terms of the NCD Public Issue across different series

Company Profile

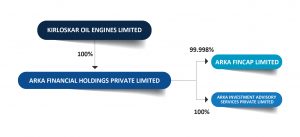

- Arka Fincap Limited, an RBI-licensed entity, stands as a customer-centric, digitally enabled, systemically important Non-Banking Finance Company (NBFC) and a part of the Kirloskar Group. It was established in 2018 and provides secured and unsecured financing solutions to MSMEs, SMEs, developers, and corporates.

- Arka operates in 17 cities across the West, South, and North regions in India, with a workforce of over 300 employees spread across its branches. Its registered office is located in Mumbai.

- Arka is primarily engaged in providing structured term financing solutions to corporates, real estate and urban infra financing, loans to micro, small, and medium enterprises (“MSME”), and personal finance loans to borrowers in India.

- The total loan book as of September 30, 2023 stood at ₹ 4,03,319.32 lakhs. The total revenue and net profit for the quarter and half year ended September 30, 2023 (unaudited) was Rs.25,472.63 lakhs and Rs. 3,531.67 lakhs, respectively.

Corporate Structure Arka Fincap Limited Performance Highlights of Arka Fincap Limited for half year ended September 30, 2023

Financial Metrics across Arka’s Businesses

- The company’s total borrowings (debt securities and borrowings) as of September 30, 2023, amounted to Rs. 3,15,368.49 lakhs. It relies on long-term, medium-term, and short-term borrowings from various sources. Arka takes term loans, and working capital loans including cash credit facilities, issues non-convertible debentures, market-linked debentures, and commercial papers. It has a diversified lender base comprising public sector banks, private banks, and others. Their ability to meet debt service obligations and repay outstanding borrowings will depend primarily on the cash generated by their business, which depends on the timely repayment by its customers.

- Out of the Company’s Loan Book of Rs. 4,03,319.32 lakhs as of September 30, 2023, 88.78% of the aggregate Loan Book i.e., Rs. 3,58,069.03 lakhs were secured loans, and Rs. 45,250.29 lakhs representing 11.22% of the Loan Book are unsecured loans primarily comprising of MSME loans and personal finance loans.

- As of September 30, 2023, and March 31, 2023, GNPAs accounted for 0.19% and 0.01% of Gross Advances, respectively. There was no GNPA in Fiscal 2022 and Fiscal 2021. Further, as of September 30, 2023, and March 31, 2023, NNPAs accounted for 0.05% and 0.00% respectively, of Gross Advances. There were no NNPAs in Fiscal 2022 and Fiscal 2021. The average cost of borrowings as of September 30, 2023, March 31, 2023, March 31, 2022, and March 31, 2021, were 9.60%, 9.53%, 8.70%, and 9.27%, respectively.

Financial Parameters of the Company:

(Rs. in lakhs)

| Particulars | FY 2021 | FY 2022 | FY 2023 | For the half year ended September 30, 2023 |

| Profit after tax | 1,688.34 | 3,251.67 | 6,136.46 | 3,531.67 |

| Net Worth | 66,688.14 | 82,692.78 | 1,03,303.99 | 1,13,083.30 |

| Interest Income | 9,788.32 | 19,210.33 | 35,074.05 | 23,034.41 |

| Interest Expense | 3,768.91 | 9,173.74 | 19,617.28 | 14,444.78 |

| % Stage 3 Loans on Loans | NIL | NIL | 0.01% | 0.19% |

| % Net Stage 3 Loans on Loans | NIL | NIL | NIL | 0.05% |

| Tier 1 Capital Adequacy Ratio (%) | 57.54% | 30.57% | 24.04% | 26.13% |

| Tier II Capital Adequacy Ratio (%) | 0.31% | 0.34% | 1.44% | 1.46% |

Performance Highlights of Arka Fincap Limited 2023 for the half year ended September 30, 2023.

Rating Rationale

For ratings, CRISIL Ratings has assessed Arka’s standalone credit risk profile and support from its parent company KOEL, 100% ultimate shareholding, and KOEL’s strong moral and financial obligations to support it.

Strengths

- Strategic importance to, and expectation of strong support from KOEL

- Adequate capitalization for initial stages of operations funded by its parent company

Weakness

- Nascent stage of operations

Since operations commenced in April 2019, they are still in the initial stages.

Investor Categories

The investor categories in a bond public issue can be said to be the various segments or types of investors who can participate in the offering. The allocation ratio is determined by the issuer following guidelines set by regulatory bodies such as SEBI, aiming to distribute the existing bonds among different categories of investors. Here is the allocation ratio for the Arka Fincap Limited Public Issue across these categories.

Category I- Institutional Portion- 25% of the overall issue size- Public Financial Institutions, Insurance companies, Scheduled Banks, Provident Funds, AIFs, etc.

Category II– Non-institutional Investors- 25% of the overall issue size- Companies, Co-operative Banks, Trusts, Partnership Firms, Association of Persons, etc.

Category III– High Net-worth Individual Investors- 25% of the overall issue size- Resident Indian individuals or Hindu Undivided Families through the Karta applying for an amount aggregating to above Rs. 10,00,000 across all options of NCDs in the Issue.

Category IV– Retail- 25% of the overall issue size- Resident Indian Individuals or Hindu Undivided Families through Karta applying for an amount aggregating up to and including Rs. 10,00,000.

How to Apply through TheFixedIncome.com?

Invest In Bond Public Issue Now!

Information Memorandum:

An Information Memorandum (IM) is a comprehensive document that includes extensive details about the bond offering. It provides in-depth insights into the issuer’s business, financial history, management team, details of offerings, associated investment risks, and allocation of funds from the issue, as well as regulatory and legal disclosures.

The link to the Information Memorandum of bond public issue of Arka Fincap Limited is given below:

https://www.thefixedincome.com/storage/bondprimary_imfiles/1701320507ArkaIM.pdf

Conclusion

Wrapping up, the bond public issue by Arka Fincap Limited is an excellent opportunity for investors seeking to invest in Secured Rated Listed Redeemable Non-Convertible Debentures. Investors can take advantage of this opportunity and avail the returns associated with the public issue. Before investing, investors must go through the IM thoroughly and take into account their risk appetite and investment objectives.

Disclaimer: Investments in debt securities are subject to risks. Read all the offer-related documents carefully.