Fixed Income securities like Bonds play a big role in diversifying investment portfolios. The most important question an investor has when investing their earnings in fixed-income securities is what happens if the company defaults and they lose their money. A solution would be to invest in safe instruments like Government Bonds (G-secs) or Government Guaranteed Bonds wherein the credit risk can be minimized. You can learn more about what government guaranteed bonds are and how they work, as well as why one should invest, by reading this article.

A bond is debt raised by a company to finance a variety of projects and activities. With bonds, the company is obligated to pay interest at a predetermined rate (coupon rate) to the lenders (investors) at fixed intervals of time. The issuer usually pays the coupon quarterly, semi-annually, annually or cumulatively along with the initial investment amount (principal) at maturity. But in case the issuer is unable to repay the interest or principal amount, then the company goes into liquidation proceedings.

Government guaranteed bonds are types of bonds issued by state owned corporations wherein the government generally extends an unconditional and irrevocable guarantee for timely interest and principal payments. In case of default or bankruptcy, the government shall pay all the outstanding dues to the bondholders. These instruments can be guaranteed by the state or the central government. They are an attractive investment option for investors seeking a safe and reliable way to earn interest income, as it reduce the default risk. The long-term nature of these bonds also provides investors with a steady stream of cash flow over time from their idle funds.

Lets understand it with an example:

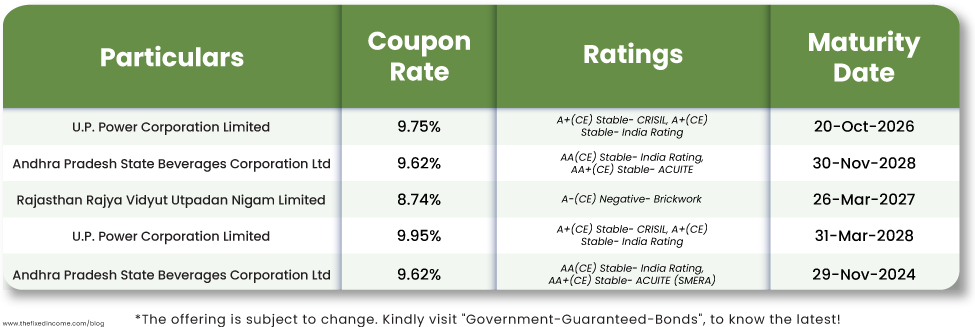

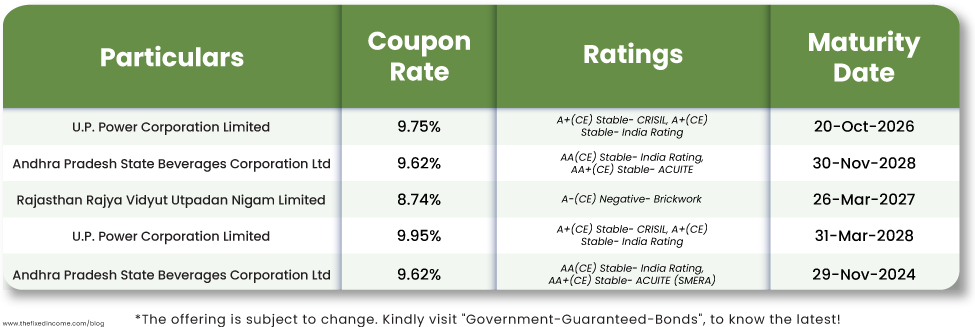

Many state governments extend an unconditional and irrevocable guarantee to state owned enterprises at the time of issue of Bonds. In case the issuer defaults in servicing interest or principal payments, the government will pay the due interest and principal amount to the bondholders. Examples of government guaranteed bonds are UP Power corporation Ltd, AP State Beverages Corp Ltd., Mahanagar Telephone Nigam Ltd. etc. which are backed by the government guarantee and you can invest easily in them through the TheFixedIncome.com

The investors that are eligible for investing in government guaranteed bonds are individuals, Hindu Undivided Family, trust, limited liability partnerships, partnership firm(s), portfolio managers registered with SEBI, association of persons, companies and bodies corporate including public sector undertakings, scheduled commercial banks, regional rural banks, financial institutions, insurance companies, mutual funds, foreign portfolio investors and any other investor eligible to invest in these bonds in accordance with applicable law. Investing in a particular instrument may have different eligibility criteria, so it is important to carefully read the term sheet, Information Memorandum and other documents before investing.

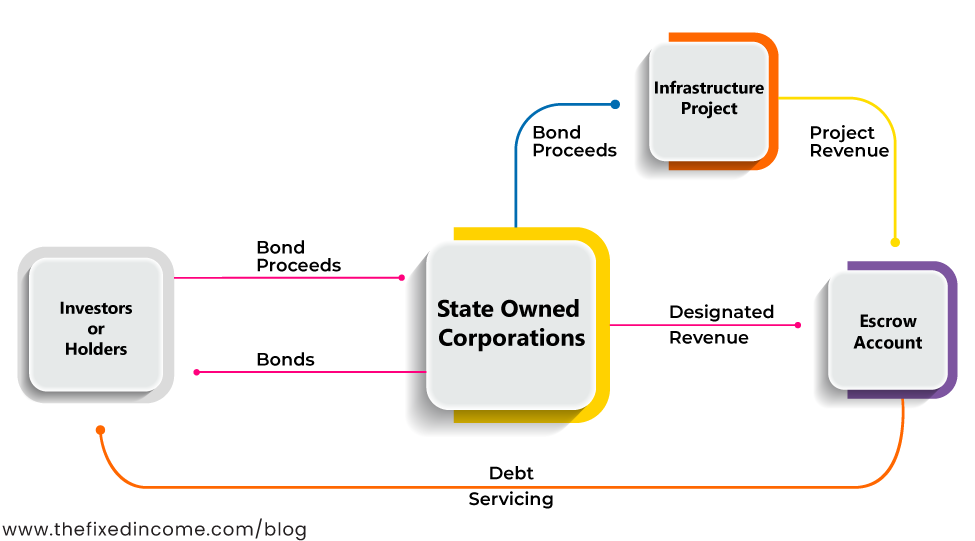

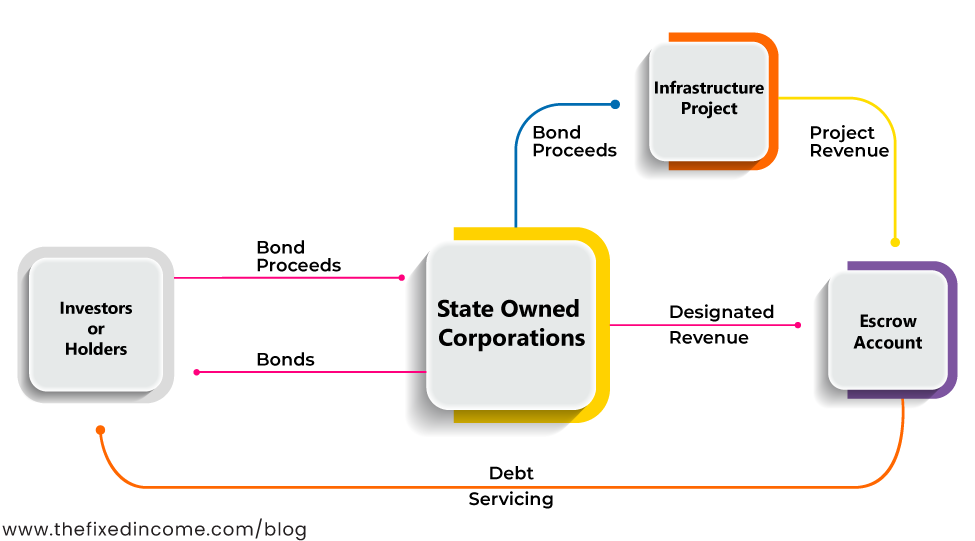

How do Government Guaranteed bonds work?

Bonds are a way to raise funds for the company for various reasons like expansion. Repayment of existing debt, financing new projects etc. The cost to raise funds will be higher for entities having weaker positions and it would be difficult to raise funds from the public. The coupon rate of the company is defined on the basis of its credit quality and financial soundness. As a result, this guarantee from the government can be a boon to these state owned companies and enable them to raise funds through the medium of bonds.

In case of government guaranteed bond, the issuer is generally required to open a designated escrow account exclusively for the benefit of and charged to the Debenture Trustee. As per the terms defined in structured payment mechanism, predefined amounts are to be replenished at designated time points to the escrow account from funds raised from the project or from revenue of the company for servicing of the debt obligations. One must carefully go through the Information Memorandum of the issuer to understand the above mentioned terms, as they can vary from issue to issue.

However, it is important to note that government guaranteed bonds are different from secured bonds wherein the debt is secured by an asset of the company and at the time of liquidation, the investors are given the first priority to the collateral. Government Guaranteed bonds can be secured as well as unsecured. Thus before investing ensure that you understand all the terms of issue or you can contact our competent relationship managers who will be happy to answer all of your questions and help clear up any doubts you have.

Pros of the Government Guaranteed bonds can be briefly explained as follows:

Investing in government-guaranteed bonds is a great way for investors to benefit from the stability and security of the state owned entity and the issuing government while still earning attractive returns on their investments.

To mitigate high risks from other asset classes like equity, alternative investment funds etc. and diversify your overall investment portfolio one can stipulate a portion to government guaranteed bonds based on their risk profile.

Government Guaranteed bonds are listed on the stock exchanges and thus can be bought and sold in the secondary market.

Regular and fixed interest payments are provided by government-guaranteed bonds, which can be helpful for your future financial commitments, such as EMIs or fixed payment obligations.

List of Top Government Guaranteed Bonds on TheFixedIncome.com portal

To wrap it up, it can be concluded that Government Guaranteed Bonds can be used as an alternative to traditional investments, providing investors with a safe and reliable source of income over time. As a result, investors can diversify their portfolios with these fixed income instruments while taking low risks and in the event of default, the government can step in and pay their dues before the non-guaranteed bondholders.

Disclaimer: Investing in Bond is subject to market risks. Please read all the documents carefully before investing in Bonds.