Edelweiss Financial Services Limited is offering Secured, Rated, Listed, Redeemable Non-Convertible Debentures which is opening on January 09, 2024, and closing on January 22, 2024. This investment holds promising opportunities for investors due to its A+/Stable by CRISIL and A+/ Negative by ICRA and its strong profile and impressive financial track record. This blog provides valuable insights about the company, its current offering, and its financial performance. Below are the details of the issue:

Issue Highlights

| Issuer Name | Edelweiss Financial Services Limited |

| Nature of Instrument | Secured Rated Listed Redeemable Non-Convertible Debentures |

| Rating | A+/Stable by CRISIL and A+/ Negative by ICRA |

| Seniority | Senior |

| Face Value | Rs. 1,000 per NCD |

| Issue Size | Rs.125 crores with with green shoe option of Rs.125 crores |

| Coupon | Up To 10.45% |

| Tenor | 24/36/60/120 months |

| Issue Date | January 09, 2024, to January 22, 2024 |

| Minimum Investment | Rs. 10,000 only |

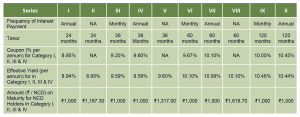

Specific Terms of the NCD Public Issue across different series

Company Profile

- Edelweiss Financial Services Limited (EFSL) was founded in 1995. It is one of India’s leading financial services conglomerates offering the right financial solutions for every stage.

- Edelweiss Group is promoted by Mr. Rashesh Shah and Mr. Venkat Ramaswamy, who are seasoned professionals in the financial services industry with over three decades of experience.

- The company, based in Mumbai, services its client base of ~6.3 million through a network of 24 offices and nearly 6,176 employees as of September 30, 2023.

- EFSL is a diversified company with having presence in sectors like:

a) Retail as well as Corporate Credit

b) Asset Management & Resolution

c) Wealth Management and

d) Insurance businesses

Financials Highlights for the Quarter ended September 2023:

Financial Metrics across Edelweiss Financial Services Limited’s Businesses as of September 30, 2023.

Alternative Asset Management

The Edelweiss Group is one of the dominant players in the alternative asset management segment.

- Aum grew 25% YoY to Rs. 50,000 cr.

- Rs. 40,000 cr of investment opportunities in advanced stages of deployment.

- Alts PAT 42% YoY. Its PAT stood at Rs. 45 cr.

Mutual Funds

- AUM grew 25% YoY to Rs. 1,14,000 cr.

- Equity AUM grew by 30% YoY to Rs. 34,200 cr.

- Healthy profitability across businesses: MF PAT 55% YoY. Its PAT stood at Rs.12 cr.

Asset Reconstruction

- Aum stood at Rs. 37, 650 cr.

- PAT stood at Rs. 81 cr.

NBFC

- Wholesale book reduced by ~50% YoY to INR 4,350 Cr; expect momentum to continue.

- AUM stood at Rs. 6714 cr.

- Its PAT stood at Rs. 35 cr.

Gross premium for life insurance business increased by 18% YoY

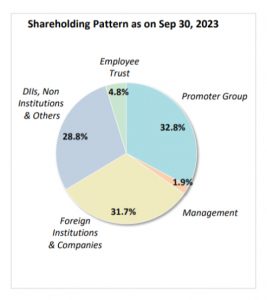

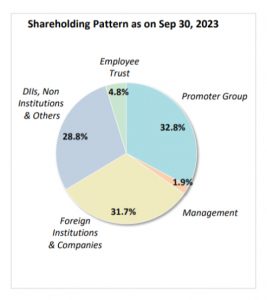

Key Shareholders:

- Pabrai Investment Funds- 9.3%

- TIAA CREF funds- 4.2%

- BIH SA- 3.9%

- LIC- 2.6%

- Baron Asset Management- 2.5%

Other shareholders include Vanguard Group, Flowering Tree Investment Management, Blackrock, etc.

![]()

![]()

Rating Rationale

The rating rationale outlines the following key factors influencing the ratings of Edelweiss Financial Services Limited:

Strengths

-

Diversified presence in credit and non-credit segments

The Edelweiss Group is a diversified financial services player involved in the credit, asset management, asset reconstruction, life, and general insurance businesses. To diversify its revenue stream and lessen its reliance on capital markets, the Group ventured into other segments like credit, distressed assets, life insurance, and general insurance.

-

Financial flexibility supported by the ability to monetize investments in businesses incubated over the years

The group possesses the ability and the willingness to monetize its investments by diluting or selling equity stakes in businesses it has nurtured and grown it over the years. This strategy has helped boost its overall cash flows during periods when its business cash flows faced challenges.

-

Adequate capitalization, supported by multiple capital raises

Despite the tough macroeconomic environment, Edelweiss Group has raised Rs. 4,400 crore since 2016 from global investors across businesses such as lending, wealth management, and asset management businesses. This served as an anchor to maintain the capital position, despite raised credit costs and absorb the asset-side risks. The group’s net worth stood at Rs 6262 crore as of September 30, 2023, as against Rs 8581 crore as of March 31, 2023.

-

Proven capacity to build a strong competitive position across businesses

The Edelweiss group is a diversified financial services player, engaged in credit, insurance, asset management, and asset reconstruction. The group is a leading player in the alternate asset and asset reconstruction businesses and is focussing on building market position in other businesses too, which would lead to greater stability to earnings over some time.

Weakness

-

Subdued profitability for current size and scale considering a presence in multiple businesses

The Edelweiss Group has been reporting profit across its businesses since the last quarter of fiscal 2021. The Profit After Tax was Rs 406 crore in fiscal 2023, a notable improvement from Rs 212 crore and Rs 254 crore in fiscal 2022 and fiscal 2021 respectively. The first half of fiscal 2024 reported an improved PAT of Rs 173 crore, excluding any exceptional items. However, the pace and quantum of this profitability improvement have fallen short of earlier expectations. The group’s overall profitability is being dragged down by losses in its insurance ventures.

-

High portfolio vulnerability

CRISIL highlighted some issues regarding the asset quality of the Edelweiss group. While the on-book wholesale loans in the non-banking financial companies (NBFCs) have declined, the Group’s portfolio vulnerability remains high, given its presence in the wholesale/real estate segment and the investments held in the form of credit substitutes (comprising SRs and units of AIFs) backed by wholesale assets. However, the group has maintained a reasonable level of collateral cover on most of this portfolio.

-

Weak profitability; Boosting profits requires refocusing on core strategies.

The high credit costs/ impairments/management overlays owing to stress build-up in the wholesale book have been a drag on the Group’s profitability.

Investor Categories

The investor categories in a bond public issue can be defined as the various segments or types of investors who can participate in the offering. The allocation ratio is established by the issuer according to the guidelines set by regulatory bodies such as SEBI for distributing the existing bonds among different sets of investors. Here is the allocation ratio for Edelweiss Financial Services Limited’s Public Issue across these categories.

Category I- Institutional Portion- 10% of the overall issue size- Public Financial Institutions, Insurance companies, Scheduled Banks, Provident Funds, AIFs, etc.

Category II– Non-institutional Investors- 10% of the overall issue size- Companies, Co-operative Banks, Trusts, Partnership Firms, Association of Persons, etc.

Category III– High Net-worth Individual Investors- 40% of the overall issue size- Resident Indian individuals or Hindu Undivided Families through the Karta applying for an amount aggregating to above Rs. 10,00,000 across all options of NCDs in the Issue.

Category IV– Retail- 40% of the overall issue size- Resident Indian Individuals or Hindu Undivided Families through Karta applying for an amount aggregating up to and including Rs. 10,00,000.

How to Apply through TheFixedIncome?

Information Memorandum:

An Information Memorandum (IM) is a detailed document that provides investors with in-depth information about the bond issue. It contains thorough insights into the issuer’s business, financial background, management team, details of offerings, associated investment risks, and fund allocation from the issue, besides regulatory and legal disclosures.

The link to the Information Memorandum of bond public issue of Edelweiss Financial Services Limited is given below:

https://www.thefixedincome.com/storage/bondprimary_imfiles/17043458221704171700950.pdf

Conclusion

Wrapping up, the bond public issue by Edelweiss Financial Services Limited offers an excellent opportunity for investors interested in investing in Secured Rated Listed Redeemable Non-Convertible Debentures. Investors can participate in the offering and reap the returns provided by this issue. Nevertheless, before investing, investors must study the IM properly and take into account their risk appetite and investment objectives.

Disclaimer: This article is based on publicly available information and other sources believed to be reliable. The information provided in this article is intended for general, educational, and awareness purposes only and should not be considered a comprehensive disclosure of every material fact. It should not be interpreted as investment advice for any individual or entity. The article makes no guarantees regarding the completeness or accuracy of the information and disclaims all liabilities, losses, and damages arising from the use of this information. Investments in debt securities/ municipal debt securities/securitized debt instruments are subject to risks including delay and/ or default in payment. Read all the offer-related documents carefully.