Motilal Oswal Financial Services Limited is offering Secured, Rated, Listed, Redeemable Non-Convertible Debentures on April 23, 2024, and is closing on May 07, 2024. This investment holds promising prospects for investors, backed by its CRISIL rating of AA/Stable, strong company profile, and notable financial history. This blog offers valuable insights into the company, its current offering, and its financial performance. Below are the issue details:

Issue Highlights

| Issuer Name | Motilal Oswal Financial Services Limited |

| Nature of Instrument | Senior Secured Redeemable Non-Convertible Debentures |

| Rating | AA/Stable by CRISIL |

| Seniority | Senior |

| Face Value | Rs. 1,000 per NCD |

| Issue Size | ₹500 crores with green shoe option of Up to ₹500 crores |

| Coupon | Up To 9.70% |

| Tenor | 24/36/60/120 months |

| Issue Date | April 23, 2024, to May 07, 2024 |

| Minimum Investment | Rs. 10,000 and in multiple of 1 NCD thereafter |

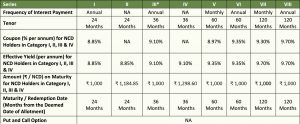

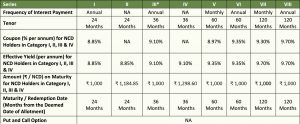

Specific Terms of the NCD Public Issue across different series

Company Profile

- Motilal Oswal Group Limited started operations in 1987 as a provider of sub-broking and prudential portfolio services. It is one of the largest full-service brokers in India with the highest gross brokerage revenue as of March 31, 2023.

- The “Motilal Oswal” brand has built an online and digital broking and financial services platform over the last few years.

- The company has a network of over 2,500 business locations spread across over 550 cities in India.

- The company’s assets under advice stood over ₹4,40,123.09 crores as of December 31, 2023.

- The group offers a diversified range of financial products and services such as:

- Retail broking and distribution

- Institutional broking

- Investment banking

- Asset management

- Private Equity

- Real estate

- Wealth management

- Housing finance

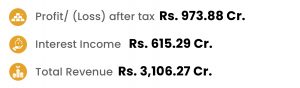

Performance Highlights of Motilal Oswal Financial Services Limited for the Quarter ended December 2023 (Standalone Basis) Graphic

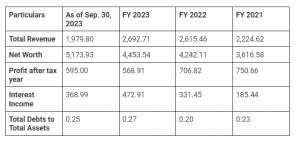

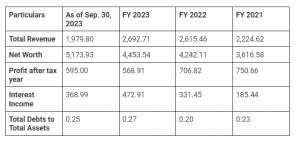

Key Operational and Financial Parameters

Financial Metrics across Motilal Oswal Group’s Business.

The revenue from each of the below-mentioned business segments in nine-month period ended December 31, 2023.

| Description | Amount (in Rs. cr.) | % |

| Capital markets | 2,932.29 | 58.97 |

| Asset and wealth management | 785.03 | 15.79 |

| Housing finance | 433.46 | 8.72 |

| Treasury investments | 1,044.60 | 21.01 |

| Unallocated | 0.29 | 0.01 |

| Inter-Company | (223.31) | (4.49) |

| Total Revenue from Operations | 4972.36 | 100.00 |

-

Capital Markets

Broking Services

Our Company is one of the largest full-service brokers in India with the highest gross brokerage revenue as of March 31, 2023, amongst players in the broking industry (Source: CRISIL Report). The brokerage and fees income was ₹1,640.30 crores, ₹1,756.49 crores, ₹1,656.67 crores, and ₹1,241.61 crores for the period ended December 31, 2023, and in the Financial Years 2023, 2022 and 2021, respectively.

Client Acquisition

The company increased its retail client base by 29.67% CAGR from 0.20 crores in the Financial Year 2021 to 0.40 crores as of December 31, 2023.

-

Asset and Wealth Management

The AUM of the asset management services amounted to ₹64,857.35 crores as of December 31, 2023, as compared to ₹45,692.00 crores as of March 31, 2021. As of December 31, 2023, the share of alternate assets, comprising PMS and AIF ranks among the highest in the asset management industry at 33.52%.

As of December 31, 2023, MOWL, a subsidiary of MOFSL, has offered wealth management services to 6,301 families which witnessed a growth of 26.00% YoY. The wealth AUM was ₹51,997.00 crores as of March 31, 2023, and reached an all-time high of ₹89,632.00 crores as of December 31, 2023, registering a growth of 117.00% YoY.

-

Housing Finance

MOHFL, a subsidiary of MOFSL, reported a PAT of ₹136.36 crores in the Financial Year 2023, registering a staggering growth of 43.66% YoY. MOHFL’s RoA improved to 368.00% for the nine-month period ended December 31, 2023, which was largely driven by better utilization of existing infrastructure, control over delinquencies, and reduction in cost of funds.

-

Treasury Investments

The treasury investment book has grown to ₹5,871.85 crores as of December 31, 2023. These investments serve as collateral to support working capital needs for our Company’s broking business. MOFSL further uses these investments for seeding multiple operating businesses and sponsoring asset management companies, private equity, and real estate funds.

Strengths

Several strengths have significantly contributed to the company’s growth and expansion. These strengths have played a vital role in bolstering the company’s market position in the market and facilitating its success.

-

A prominent full-service broker renowned for its strong brand equity and established track record.

As of March 31, 2023, the company is one of India’s largest full-service brokers, with the highest gross brokerage revenue in the broking industry (Source: CRISIL Report). As of December 31, 2023, the group, through MOFSL, stood among the top 10 equity brokers considering several active clients in the fragmented broking sector. The company boasted 8.2 lakh active customers on the National Stock Exchange, compared to 8.0 lakh as of March 31, 2023, as of December 31, 2023.

-

A diversified business model and products available across different segments.

The company provides diverse products and services across various sectors such as broking and distribution, institutional equities, investment banking, asset management, wealth management, private equity, real estate, and affordable housing finance. The contribution of these businesses to its overall revenue has increased in recent fiscal periods.

-

Client acquisition through direct channels and an extensive network of Business Associates.

The company’s broking business emphasizes the ‘Phygital Business model’, a combination of a physical and a digital model, which helped in expanding their client base to 0.40 crores as of December 31, 2023, growing at a CAGR of 29.67% over from Financial Year 2021 to December 31, 2023.

-

Experienced management team

The company’s robust management team comprising of qualified and experienced professionals with successful track records and substantial experience in the industry has played a pivotal role in transforming its business from a predominantly physical to a substantial digital model over recent years.

-

A steady history of financial performance and a strong balance sheet.

The consolidated total revenue from operations increased by 15.49% from ₹3,634.12 crores in Fiscal 2021 to ₹4,197.12 crores in Fiscal 2023 and was ₹4,972.36 crores in the nine months ended December 31, 2023.

Weakness

The risks and uncertainties mentioned in this section are not the only risks faced by the company. There may be other unknown risks and uncertainties as well that may be considered immaterial at present, which could also impact their business, financial condition, and operational results.

- The company’s capacity to assess and manage inherent business risks is hindered by the standards of some of its counterparts. Inadequate risk management can harm their business, finances, and operations.

- Operational risks associated with the financial services sector, if realized, could hurt the company’s business, financial health, cash flows, operational results, and prospects.

- The company faces substantial competition in its operations, which could restrict its growth and opportunities.

Investor Categories

Investor categories in a bond public issue refer to the various segments of investors who are eligible to participate in the offering. The allocation ratio, determined by the issuer following guidelines from regulatory bodies like SEBI, distributes existing bonds among different sets of investors. Below are the allocation ratios for Motilal Oswal Financial Services Limited’s Public Issue across these categories.

Category I- Institutional Portion- 10% of the overall issue size- Public Financial Institutions, Insurance companies, Scheduled Banks, Provident Funds, AIFs, etc.

Category II– Non-institutional Investors- 10% of the overall issue size- Companies, Co-operative Banks, Trusts, Partnership Firms, Association of Persons, etc.

Category III– High Net-worth Individual Investors- 40% of the overall issue size- Resident Indian individuals or Hindu Undivided Families through the Karta applying for an amount aggregating to above Rs. 10,00,000 across all options of NCDs in the Issue.

Category IV– Retail Investors- 40% of the overall issue size- Resident Indian Individuals or Hindu Undivided Families through Karta applying for an amount aggregating up to and including Rs. 10,00,000.

How to Apply through TheFixedIncome?

Information Memorandum:

An Information Memorandum (IM) is a detailed document crafted to provide investors with comprehensive insights about the bond issue. It offers an in-depth insight into the issuer’s business operations, financial history, management structure, details of the offerings, potential investment risks, and fund distribution from the issue. It also includes regulatory and legal disclosures.

The link to the Information Memorandum of bond public issue of Motilal Oswal Financial Services Limited is given below:

https://www.thefixedincome.com/storage/bondprimary_imfiles/1713266536MOTILAL_OSWAL_IM.pdf

Conclusion

Summing up, the bond public issue by Motilal Oswal Financial Services Limited presents a promising opportunity for investors interested in investing in Secured Rated Listed Redeemable Non-Convertible Debentures. Those seeking to participate can engage in the offering and benefit from the returns provided by this issue. Nonetheless, it is crucial for investors to meticulously review the Information Memorandum (IM) and evaluate their risk tolerance and investment goals before making any investing decisions.

Disclaimer: This article is based on publicly available information and other sources believed to be reliable. The information provided in this article is intended for general, educational, and awareness purposes only and should not be considered a comprehensive disclosure of every material fact. It should not be interpreted as investment advice for any individual or entity. The article makes no guarantees regarding the completeness or accuracy of the information and disclaims all liabilities, losses, and damages arising from the use of this information. Investments in debt securities/ municipal debt securities/securitized debt instruments are subject to risks including delay and/or default in payment. Read all the offer-related documents carefully.