If you’re thinking about investing in India, you’ll discover numerous investment options. One of the most popular choices is bonds. These are essentially loans that companies or governments issue to raise funds. They pay interest to bondholders for a fixed term, then redeem the bond at face value.

In India, you can invest in two main kinds of bonds: government and corporate. Let’s compare two types of bonds and determine which aligns with your investment goals.

Government Bonds

Did you know that government bonds get their name from being issued by the Indian government? These bonds are considered one of the safest investment opportunities available due to the government’s strong creditworthiness. When the bond matures, investors get back their principal amount. The interest payments are generally made on a semi-annual basis! Government Bonds are almost risk-free as they are backed by the Government; that is why they are also known as risk-free gilt-edged securities. It’s a smart choice for anyone looking for a stable and secure investment option.

If you’re considering government bond investment, there are various options available:

- Invest in Government Bonds through platforms like TheFixedIncome.

- Invest in government bonds through the RBI Direct Platform, banks, or the National Stock Exchange of India.

- Consider investing in bond funds that focus on government securities.

If you’re someone who wants to ensure their investments are safe and secure, government bonds should be on your investment options. For cautious investors seeking long-term financial stability, diversifying a portfolio with low-risk government bonds is ideal. While investing in corporate bonds yields higher returns income, it comes with more risk.

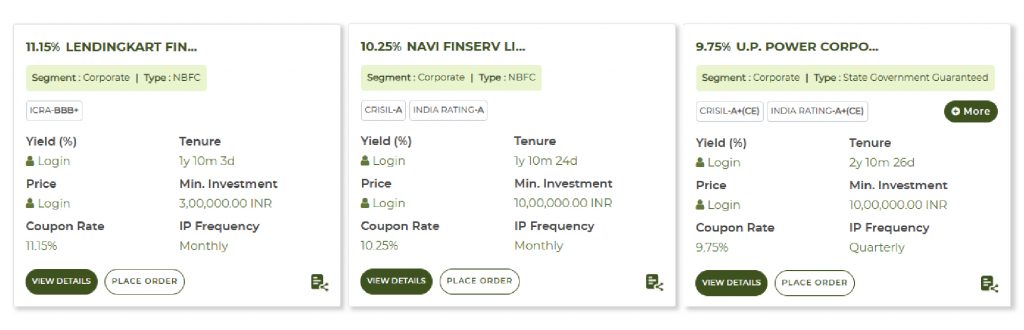

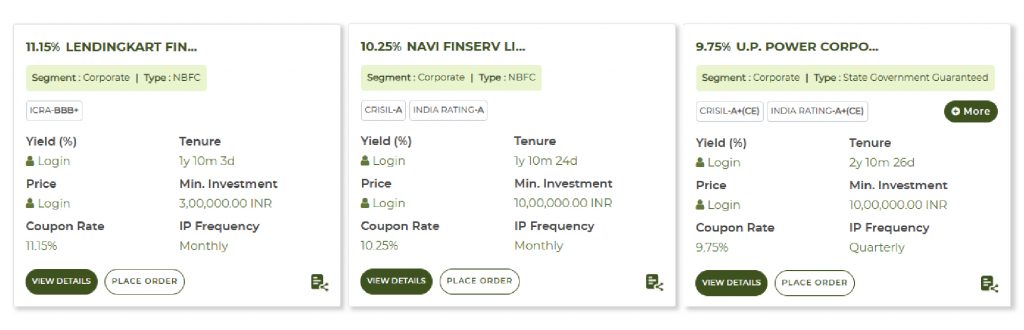

Here are available investment options in the government bonds section-

Corporate Bonds

When companies need to raise funds, they issue corporate bonds, a type of debt security. Unlike government bonds that provide sovereign security, corporate bonds vary in credit quality among different issuers, making them generally perceived as riskier investments.

Before investing in corporate bonds, evaluate your risk tolerance and investment objectives. While these bonds provide higher returns, they may also come with greater risks. These bonds usually offer better returns compared to government bonds.

Investing in Corporate Bonds can be done in a few different ways:

- Investing in specific company bonds through investment platforms like TheFixedIncome or bond mutual funds/ETFs are few approaches to investing in corporate bonds.

- Corporate bonds are available for purchase on exchanges, as they are listed and can be traded by investors.

Investors can also build a bond ladder which involves purchasing a series of individual bonds with staggered maturity dates. This approach helps manage interest rate risk and provides a steady income stream.

Investors can also reinvest principal in new bonds or use it for other purposes upon bond maturity.

Are you an investor looking for higher yields than what government bonds can offer? If so, corporate bonds may be the perfect investment for you! When contemplating an investment in corporate bonds, it is essential to consider the heightened risk that is involved. It is essential to consider the risk of a company’s failure and the potential financial losses while investing. Being willing to take risks and adapt to market changes is crucial. Although corporate bonds offer profit potential, it’s crucial to acknowledge the associated risks.

Some of the alternatives available in this segment include:

Which One is Right for You?

When deciding between government and corporate bonds, it’s important to consider essential factors. Your investment objectives, capacity for risk, and current financial circumstances all play a major role in determining the best approach. For a well-informed conclusion, consider these points:

Investing in government bonds:

If you like to play it safe when it comes to investing and value steady income, then government bonds might be the perfect fit for you. Unlike corporate bonds, which face credit risks and default risks, government bonds are known for their low-risk nature. For those seeking reliable and predictable returns, government investments are an ideal choice.

Also, as per new SEBI margin norms, members are required to maintain at least 50% of the total collateral in the form of cash or cash equivalents. When investing in Government Securities, the investors have the added advantage of pledging the securities for cash margin requirements. Typically, investors can obtain around 80-95% of the collateral value as a margin.

Lets us understand this with the help of an example. Suppose you invest ₹10 lakh in government security called 7.54% GS 2036. With this investment, you will be able to get a margin of approx ₹9 lakhs (₹10 lakhs – haircut 10%). This margin is calculated by subtracting a certain percentage known as a haircut from the initial investment. In this case, the haircut is 10%.

In summary, investing in government securities not only offers the potential for attractive returns but also allows you to pledge it for your margin requirements under equity. Thus, adding G-Sec/ T-Bills to your investment portfolio can help diversify your portfolio and also bring down overall risk factors. The minimum investment begins at a modest ₹10,000/-, catering to investors with a smaller ticket size.

Investing in corporate bonds:

Are you ready to take on some risks and earn higher yields than government bonds? If so, corporate bonds could be the investment opportunity you’re looking for! By adding corporate bonds to your portfolio, you increase your chance of maximizing returns.

Before investing in any company’s bonds, it’s crucial to conduct thorough research. Before investing, carefully review the company’s financial information to assess your comfort level with the associated risks. It is important to consider the credit ratings assigned to the issuer by accredited rating agencies like CRISIL, ICRA, CARE, etc. One way to potentially improve your investment strategy is to spread out your portfolio among various companies of different sectors with different maturities. This way, you can spread out your investments and potentially minimize any negative impact from any one particular company.

However, investing in corporate bonds may come with higher risks to consider. However, careful research and due diligence can help you make better investment decisions and potentially see significant returns. So, take the time to do your research and consider adding corporate bonds to your investment portfolio.

Understanding Recent Trends and Emerging Opportunities

These days, sustainable investing is becoming more popular, and with it comes the rise of green bonds. These bonds are specifically designed to fund environmentally friendly initiatives. Furthermore, India is making progress towards renewable energy and sustainable development due to government efforts. Many Indian companies and institutions have already issued green bonds, making them an exciting investment option for those interested in supporting sustainable projects.

Technology has made investing in bonds more convenient and accessible. Because of online investment platforms like The Fixed Income, investors can now buy and sell bonds from the comfort of their homes without paying any transaction charges. It means that retail investors no longer need to go through the traditional brokerage channels to invest in bonds. These platforms offer a variety of bonds at transparent pricing with no brokerage charges, making portfolio diversification easy for investors. This is definitely a game-changer in the investment world!

Conclusion

To sum it up, when it comes to opting between government and corporate bonds, both have pros and cons. Government Bonds provide a guaranteed return, while Corporate Bonds offer higher yields but carry more risk.

It is imperative to take into account your objectives, tolerance for risk, and financial position when deciding on investments. Hence, seeking the advice of a financial advisor is really crucial. They possess the expertise to guide you towards an educated decision.

Moreover, online investment platforms have made investing in government and corporate bonds much more convenient. You can now invest in these bonds from the comfort of your own home through authorized financial institutions. Also, you can conveniently keep track of your investments with experts from The Fixed Income, a SEBI registered platform. By doing some research, you can uncover bonds with high yields and create a diversified investment portfolio in India. Start exploring your options today! For more guidance, explore our website and discover valuable resources.

FAQs

Q1. How to invest in government bonds in India?

Ans: There are various ways of investing in government bonds in India:

- Invest through platforms like TheFixedIncome. It can be done in 3 simple steps:

Sign Up– Complete your KYC– Place Order

Q2. What are the basics of investing in bonds?

Ans: Investing in bonds is an excellent way to earn fixed returns and diversify portfolios. Before starting your investment journey, it is important to get your basics clear such as the different types of bonds and associated terminologies, the risks and rewards involved, and the methods to invest in bonds. Additionally, you should also know about the tax implications of investing in bonds as they can vary depending on the type of bond and other factors.

The different types of bonds available in the market. A few of them are:

- Government Bonds

- Corporate Bonds

- Treasury Bills

- State Government Guaranteed Securities

- Gold Bond

- Bond Public Issue

A few of the terminologies associated with bonds are:

Coupon rate– A coupon rate is the amount of annual interest rate paid by bond issuers to a bondholder on the face value of the bond.

Yield to maturity– The term yield to maturity is the total return anticipated on a bond if the bond is held until its maturation date.

Product Note– A product note contains all the details about the bond.

Bond Maturity– Bond Maturity is the time when the bond issuer must repay the original bond value to the bondholder.

Q3. Are government bonds risk-free?

Ans. Government bonds are generally considered low-risk investments as they are issues by the Government. The chances of a government failing to meet its loan obligations are quite miniscule.

Q4. Which is the safest corporate bond?

Ans. Corporate bonds with a credit rating of AAA are considered as highly safe in comparison with other corporate bonds. However, it is important to note that merely AAA rating does not immune against default risks.

Q5. What is the difference between a secured and unsecured bond?

Ans. In secured bonds, the borrowing entity provides an asset as security or collateral for the loan. Conversely, unsecured bonds do not have backing in the form of collateral; investors rely on their creditworthiness or their belief in the company’s ability to repay.

Q6. Is it good to invest in corporate bonds?

Ans. Corporate bonds provide attractive returns compared to other debt instruments available in the market. Their average yield ranges around 9-12%.

Q7. What is the maturity of a corporate bond?

Ans. The maturity of a corporate bond refers to its duration until maturity which can be categorized as short-term (less than three years), medium-term (four to ten years), or long-term (over 10 years). Investors can choose bonds as per their requirements.