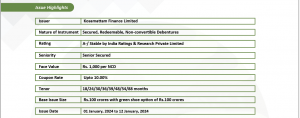

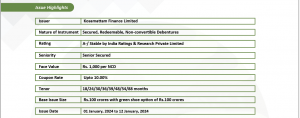

Kosamattam Finance Limited has come up with Secured, Rated, Listed, Redeemable Non-Convertible Debentures from 01 January 2024 to 12 January 2024. It is A-/ Stable rated by India Ratings. This is an attractive investment opportunity for investors as the minimum investment amount is just Rs.10,000. This blog gives an overview of the company, the issue, and its financial performance. Below are the details of the issue.

Issue Highlights

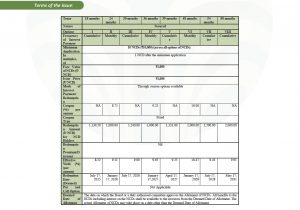

Allotment- FIRST COME FIRST SERVE BASIS

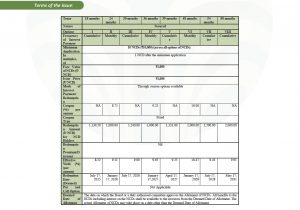

Specific Terms of the NCD Public Issue across different series

About the Company

- Kosamattam Finance Limited (KFL) is a systemically important non-deposit-taking NBFC primarily engaged in the gold loan business, lending money against the pledge of household jewelry.

- Headquartered in Kerala, KFL is a part of the “Kosamattam Group” led by Mathew K. Cherian. It operates through 994 branches spread in the states of Kerala, Tamil Nadu, Karnataka, Andhra Pradesh, Delhi, Maharashtra, Gujarat, and Telangana along with the Union Territory of Puducherry, and has employed 3,842 employees.

- In addition to the core business of gold loans, KFL is also engaged in fee-based ancillary services which include microfinance, money transfer services, foreign currency exchange, power generation, agriculture, and air ticketing services.

- As of March 31, 2023, the Gold Loan Portfolio stood at ₹ 4,45,407.85 lakhs which is 98.68% of the total loan portfolio.

- As of March 2023, Kosamattam Finance is also one of the key players in the NBFC gold loan market.

Performance Highlights of Kosamattam Finance as of March 31, 2023

Financial Parameters of the Company:

(Rs. in lakhs)

| Particulars | 31-03-2023 | 31-03-2022 | 31-03-2021 |

| Gross Gold Loans under management | ₹ 4,84,569.06 | ₹ 4,00,725.00 | ₹ 3,47,826.38 |

| Net NPA (%) | 0.68% | 0.95% | 0.86% |

| Profit after Tax | ₹ 10,699.30 | ₹ 7,892.07 | ₹ 6,524.61 |

| Networth | ₹ 76,399.26 | ₹ 65,699.56 | ₹ 52,055.99 |

| Capital Adequacy Ratio | 17.71% | 18.65% | 18.60% |

As of the current date, Promoters collectively hold 71.39% of our Company’s equity shares capital.

Financial Metrics

- The average Gold Loan amount outstanding was ₹ 50,476, ₹ 45,121, and ₹ 43,864 per loan account, for the financial years ended on March 31, 2023, March 31, 2022, and March 31, 2021, respectively.

- For the financial years ended March 31, 2023, March 31, 2022, and March 31, 2021, the yield on Gold Loan assets was 18.47%, 17.70% and 17.76%, respectively.

- For the financial years ended March 31, 2023, March 31, 2022, and March 31, 2021, the total income was ₹78,254.08 lakhs, ₹ 62,478.73 lakhs, and ₹ 54,184.17 lakhs, respectively.

Rating Rationale

India Ratings in its rating rationale has highlighted the following key factors that determine the ratings of Kosamattam Finance Ltd.:

- Continued Franchisee Expansion in Southern States

- Improved Profitability with room for Operational Efficiency Enhancement

- Stable Asset Quality amid Pandemic led Challenges

- Diversification in Funding Mix

- Adequate Liquidity Indicator

- Geographically Concentrated Portfolio

The rating agency has also highlighted few risks such as sharp rise in delinquency which could restrict capital and funding, adverse regulatory development that could impair the ability of the company to conduct its business, and the tier 1 ratio reducing below 13%, on a sustained basis, could lead to a negative implications.

Investor Categories

The investor categories in a bond public issue can be said to be the various segments or types of investors who can participate in the offering. The allocation ratio is determined by the issuer in accordance with guidelines set by regulatory bodies such as SEBI, aiming to distribute the existing bonds among different sets of investors. Here is the allocation ratio for the Kosamattam Finance Limited Public Issue across these categories.

Category I– Institutional Portion– 10% of the overall issue size- Public Financial Institutions, Insurance companies, Scheduled Banks, Provident Funds, AIFs, etc.

Category II– Non-institutional Investors- 10% of the overall issue size- Companies, Co-operative Banks, Trusts, Partnership Firms, Association of Persons, etc.

Category III– High Net-worth Individual Investors– 30% of the overall issue size- Resident Indian individuals or Hindu Undivided Families through the Karta applying for an amount aggregating to above Rs. 10,00,000 across all options of NCDs in the Issue.

Category IV– Retail– 50% of the overall issue size- Resident Indian Individuals or Hindu Undivided Families through Karta applying for an amount aggregating up to and including Rs. 10,00,000.

How to Apply through TheFixedIncome?

Investors can easily apply using the following three steps:

Information Memorandum:

An Information Memorandum (IM) is a detailed document furnishing investors with in-depth information about the bond offering. It provides thorough insights into the issuer’s business, financial background, management team, details of offerings, associated investment risks, and fund allocation from the issue, alongside regulatory and legal disclosures.

The link to the Information Memorandum of bond public issue of Kosamattam Finance Ltd. is given below:

https://www.thefixedincome.com/storage/bondprimary_imfiles/1703739431kosamattamim.pdf

Conclusion

In essence, the bond public issue by Kosamattam Finance Limited presents an excellent opportunity for investors interested in investing in Secured Rated Listed Redeemable Non-Convertible Debentures. Investors can seize this opportunity and avail the returns associated with the public issue. Before investing, it’s crucial for investors to go through the IM thoroughly and take into account their risk appetite and investment objectives.

Disclaimer: This article is based on publicly available information and other sources believed to be reliable. The information provided in this article is intended for general, educational, and awareness purposes only and should not be considered a comprehensive disclosure of every material fact. It should not be interpreted as investment advice for any individual or entity. The article makes no guarantees regarding the completeness or accuracy of the information and disclaims all liabilities, losses, and damages arising from the use of this information. Investments in debt securities / municipal debt securities / securitized debt instruments are subject to risks including delay and/or default in payment. Read all offer-related documents carefully.