NIDO Home Finance Limited (formerly known as Edelweiss Housing Finance Limited) is a Housing Finance Company and part of the Edelweiss Group. Since 2010, the company has been providing customers access to credit for various types of loans. It is rated “CRISIL AA-/Negative” by CRISIL Ratings Limited and “A+ (Stable)” by ICRA Limited. This is an exceptional chance for investors looking for promising investment opportunities. This blog delves into the company profile and the particulars of the bond and provides insights into its financial performance. The details of the NCD are given below.

Issue Highlights

| Issuer Name | NIDO Home Finance Ltd. |

| Nature of Instrument | Secured, Redeemable, Non-Convertible Debenture |

| Rating | “AA-/Negative” by CRISIL Ratings Ltd. and “A+ (Stable)” by ICRA Ltd. |

| Seniority | Senior Secured |

| Coupon | 9.20% |

| Interest Frequency | Monthly |

| Maturity | 15 September 2026 |

| Listing | BSE |

Company Profile

- NIDO Home Finance Ltd. is a non-deposit-taking housing finance company registered with the National Housing Bank. The company’s primary focus is to offer small ticket-size home loans. It was renamed NIDO (Formerly Edelweiss Housing Finance Ltd.) on May 4, 2023.

- Mr. Rajat Avasthi is the Managing Director and CEO who has over 21 years of experience in sales and corporate marketing. Before joining Edelweiss, he served as the CEO of Vodafone’s operations in Punjab, Himachal Pradesh, and Jammu & Kashmir.

- As of June 30, 2023, the company’s pan-India network spans a total of 67 offices in major Indian cities and the retail customer base was approximately 19,000.

- As of Q1 FY 2024, the company’s net worth and its assets under management (AUM) amounted to Rs. 798 crores and Rs. 4001 crores respectively.

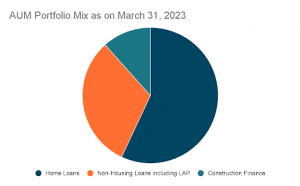

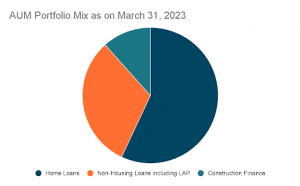

- The company’s portfolio of products includes:

- Home Loans

- Loans against Property (LAP)

- Home Improvement Loans

- Plot + Self-construction Loans

- Balance Transfer of existing loans from other banks/ Housing Finance Companies/ NBFCs

- Out of the product portfolio, the Home Loans are secured by the mortgage of the property/house for which the loan is provided. The contractual tenure of the loans generally ranges up to 20 years.

- LAP or loans against property are designed to provide loans for business purposes or for the purchase of commercial property or for investment in assets, all secured by the mortgage of the same property.

- Construction Finance, on the other hand, includes offering loans for the construction of residential projects, with mortgages of the same property and/or other collateral.

Performance Highlights of NIDO Home Finance Ltd. for the Q1 FY 24

Key Operational and Financial Parameters (Rs in million)

| Particulars | FY2023 | FY2022 | FY2021 |

| Net worth | 7944.68 | 7776.32 | 7627.88 |

| Net profit after tax | 160.63 | 138.07 | 37.29 |

| Tier I CRAR(%) | 32.06% | 28.28% | 26.49% |

| Total Debts to Total Assets | 0.77 | 0.78 | 0.81 |

| Stage 3 ratio (net) % | 1.46% | 28.28% | 26.49% |

-

-

- Total income and profit after tax of the Company as of June 30, 2023, stood at Rs. 1,098.65 million and Rs.34.59 million respectively.

-

-

-

- As of March 31, 2023, the company’s promoters- Edelweiss Financial Services Limited, Edelweiss Rural and Corporate Services Limited, and Edel Finance Company Limited hold 5.00%, 55.23% and 39.77% of our paid-up share capital, respectively.

-

Rating Rationale:

CRISIL in its rating rationale outlines the following key factors influencing the ratings of NIDO Home Finance Limited:

Strengths:

-

-

- Adequate capitalization, supported by multiple capital raises.

- Diversified financial services player, with demonstrated ability to build a significant competitive position

-

Weakness:

-

-

- Asset quality remains vulnerable

- Low profitability

-

Let’s now explore some of the differences between a Non-Banking Financial Company (NBFC) and a Housing Finance Company (HFC).

Nowadays loans have become readily available to borrowers once they meet the required eligibility criteria. The primary concern lies in choosing between loans from traditional banks and non-banking financial companies.

The major providers of Home Loans in India are banks, Non-banking Financial Companies, and Home Finance Companies. Additionally, some other lenders such as Private Finance Companies and Co-operative Credit Societies offer Home Loans.

NBFC, as the name suggests, is a financial institution that primarily focuses on providing loans and generally does not offer other banking services like deposit acceptance, fund transfers, etc.

Housing Finance Companies are a part of NBFCs that exclusively specialize in offering home loans and provide an opportunity to home buyers and businesses that want to monetize their real estate assets and developers. Also, many NBFCs have their Housing Finance subsidiaries solely providing home loans.

Reasons for Investing in Housing Finance Companies

In India, the housing finance sector has undergone a shift. Though traditional banks dominated this sector, now housing companies have become prominent. The housing finance sector continued to witness growth with the Scheduled Commercial Banks and Housing Finance Companies sharing 63% and 37% of the market respectively as of March 2022.

According to market research published by Netscribes India, it is projected that the housing finance market is expected to grow at a rate of 20.58% between the fiscal years 2022 and 2027 due to rising urbanization and low mortgage rates. Moreover, CareEdge Research predicts housing finance companies to grow by 10%-12% in FY24. This is driven by sustained demand from the affordable housing segment and an increase in the need for house ownership.

Conclusion

NIDO Home Finance Limited provides a unique opportunity to invest in secured redeemable non-convertible debentures. With a robust company profile and financial background, investing in NIDO Home Finance Limited is a lucrative option to consider.

Disclaimer: This article is based on publicly available information and other sources believed to be reliable. The information provided in this article is intended for general, educational, and awareness purposes only and should not be considered a comprehensive disclosure of every material fact. It should not be interpreted as investment advice for any individual or entity. The article makes no guarantees regarding the completeness or accuracy of the information and disclaims all liabilities, losses, and damages arising from the use of this information. Investments in the debt market are subject to market risk, kindly read all the documents carefully.