Investing in corporate debt can be profitable for those seeking to expand their portfolio and secure consistent returns. Historically, the corporate debt markets in India have primarily been available to institutional investors and high-net-worth individuals. However, the introduction of Bond Public Issue also known as NCD IPOs has opened the door for retail investors to also partake in these markets. In this blog, we will explore how Bond IPOs provide an avenue for retail investors to access the corporate debt markets in India.

Understanding Corporate Bonds

In order to properly explore the world of Bond Public Issue, it is necessary first to have a clear understanding of what corporate bonds entail. Essentially, corporate bonds are securities representing a form of debt corporations issue. Their purpose is to raise capital for various reasons, such as expanding their business or refinancing existing debt.

Investors who purchase these bonds receive periodic interest payments, commonly called coupon payments until the fixed maturity date of the bond is reached. The initial investment, known as the principal amount, is reimbursed at the conclusion of the bond’s tenure, which is also known as the maturity date.

The Importance of Corporate Debt Markets

The Indian financial system heavily relies on corporate debt markets. These markets offer companies an alternative to traditional bank loans for funding. Moreover, retail investors can diversify their investment portfolios and gain access to fixed-income instruments with attractive returns through these markets. The significance of corporate debt markets in the Indian financial system cannot be overstated. A thriving corporate debt market is beneficial to both businesses and investors.

Corporate debt markets offer businesses alternative ways to secure funding besides traditional bank loans. Due to strict lending criteria, numerous small and medium-sized enterprises (SMEs) in India find it difficult to secure bank loans. Corporate debt markets provide a practical solution for these businesses to acquire capital and finance their operations. Moreover, these markets allow companies to raise funds at a lower expense and more efficiently than traditional bank loans because they are not reliant on a single lender.

Focusing on borrowing from only one lender can be limiting. However, the expansion of the corporate debt market can actually benefit the overall economy. This market can provide corporates with a different funding option, encouraging branding and promoting economic growth. Additionally, the development of corporate debt markets can reduce the dependence on the banking sector for financing and consequently decrease systemic risks.

The Limitations Faced by Retail Investors

As a retail investor, being aware of the territory’s challenges is essential. Over time, there have been several limitations that have made it difficult for investors like you to navigate the market:

- High Minimum Investment: Corporate bonds typically feature high minimum investment requirements, making them inaccessible to retail investors with limited financial resources.

- Limited Market Access: Retail investors often encounter challenges when trying to access the primary market for corporate bonds. These markets were traditionally only accessible to institutional investors or high-net-worth individuals.

- Limited Availability of Information and Research: It can be challenging for retail investors to obtain complete information on corporate bonds, which can hinder their ability to make well-informed investment choices and raise their risk exposure. This is different from institutional investors who have dedicated research teams and resources. They may find it difficult to access detailed information about the creditworthiness of issuers, bond ratings, and other relevant factors.

The Introduction of Bond Public Issues

Corporate bonds have long been considered exclusive investment opportunities only available to institutional investors or individuals with significant wealth. This limited access has created a gap between retail investors and the corporate debt markets. However, in an effort to bridge this gap, regulators in India have introduced Bond Public Issues or NCD IPOs.

A Bond Public Issue or an NCD IPO is essentially a public offering that allows retail investors to access and invest in corporate bonds. This new approach has opened up opportunities for a wider range of investors to partake in the market and potentially benefit from the returns on corporate debt investments.

Benefits of Bond Public Issue for Retail Investors

If you’re a retail investor looking to break into corporate debt markets, a Bond Public Issue could be the answer! These Bond Public Issues offer plenty of benefits that savvy investors won’t want to miss out on:

- Lower Minimum Investment: When investing in bonds, choosing a Bond Public Issue can be an excellent option for retail investors who don’t have much capital. Bond Public Issue usually has lower minimum investment requirements of just Rs.10,000 than direct investments in corporate bonds, making it easier for smaller investors to get started.

- Primary Market Access: Investors can gain direct access to the primary market for corporate bonds through Bond Public Issues. This allows them to participate in the initial issuance and have a broader range of investment options.

- Diversification Opportunities: By investing in corporate bonds through Bond Public Issues, retail investors can diversify their portfolios and add fixed-income instruments. This strategy can help reduce overall portfolio risk and potentially provide a stable income stream.

- Liquidity: Investing in Bond Public Issues can benefit retail investors as it offers liquidity. After the initial issuance, these bonds can be traded on secondary markets, giving investors the opportunity to buy or sell their holdings according to their needs.

- Transparent Pricing and Trading: Bond Public Issues allow retail investors to participate in a transparent market with regulated pricing and trading mechanisms. In contrast to over-the-counter transactions, which may have less transparent pricing, bond public issues provide investors with a centralized and regulated market.

- Building confidence for First Time Investors: The primary issuance of bonds is regulated and closely monitored by SEBI, which acts as a guardian of the investor’s interests. SEBI’s stringent regulations are designed to ensure that the bond issuance process is transparent and investors can evaluate the risk-reward ratio of various bond options.

By doing so, they create an environment where investors can trust the information available and make well-informed investment decisions.

Therefore, investors often start their journey in the bond market by investing in primary issuances, which are regulated by SEBI. The availability of transparent pricing and comprehensive information empowers investors to make better-informed choices. As they gain confidence and become more familiar with the market dynamics, they can gradually diversify their portfolio by exploring other corporate bonds.

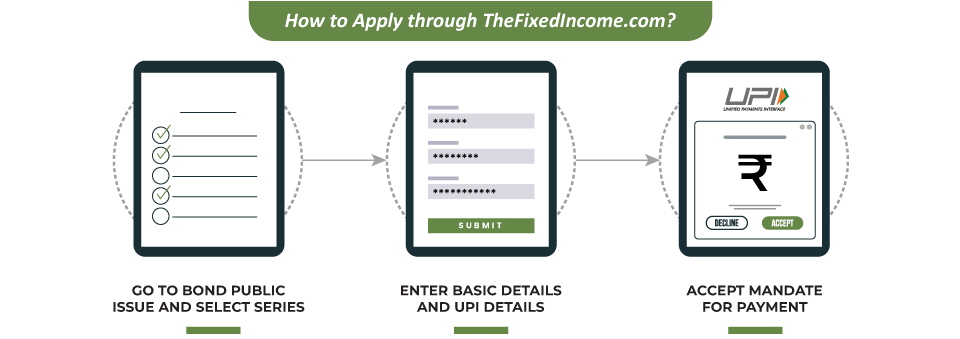

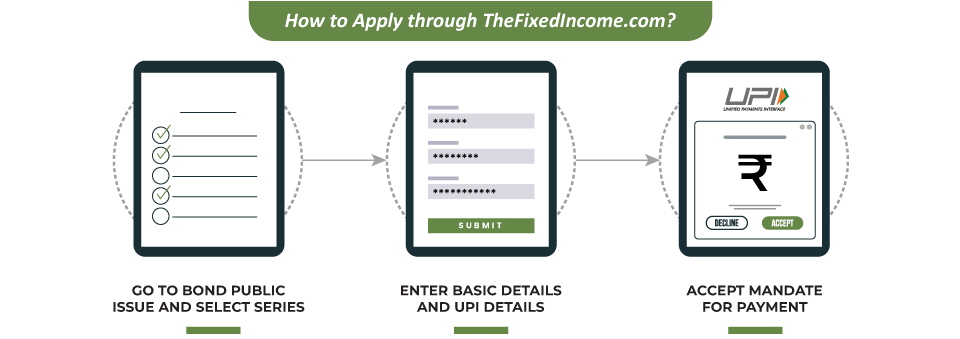

How to Apply for a Bond Public Issue?

Investing in bonds has become remarkably convenient, especially through TheFixedIncome.com. The process is simplified and accessible, allowing investors to dive into the bond market with ease. An added advantage is that No KYC or registration is required and the payment can also be made easily via UPI just like equity. Consequently, the process hardly takes a few minutes. Moreover, the minimum amount one requires for investing is also quite low at Rs.10,000 allowing prospective investors to begin their bond investment journey.

Risks and Considerations

Investing in Bond Public Issues can be attractive for retail investors, but it’s essential to keep in mind the potential risks involved:

- Interest Rate Risk: It is important for investors to understand that fluctuations in interest rates can greatly affect the value of their bond investments. Whether interest rates rise or fall, they can significantly impact the overall performance of a bond portfolio. Therefore, it is crucial for investors to stay informed and be mindful of potential changes in interest rates when making investment decisions.

- Credit Risk: Investing in bonds or other debt instruments can be risky due to the possibility of default or failure to make interest and principal payments by the issuing company. As a responsible investor, it is essential to assess the issuer’s creditworthiness before investing. This involves analyzing the company’s financial stability, performance, and debt-to-equity ratio, among other factors. By doing so, you can make an informed decision and minimize your investment risk.

- Market Conditions: The prices of bonds are subject to various factors, including the overall market conditions, economic indicators, and the emotions and attitudes of investors. Therefore, it is crucial for individual investors to carefully assess the prevailing market trends and conditions before embarking on any investment decisions.

Conclusion

Bond Public Issues have emerged as a promising option for retail investors seeking access to corporate debt markets in India. These initial public offerings provide a unique opportunity for investors to broaden their investment portfolios, earn steady returns, and be a part of the primary market for corporate bonds.

At The Fixed Income, our team of experts plays a crucial role in guiding retail investors to access corporate debt markets through Bond Public Issues. Our experts deeply understand the fixed-income market, including various types of bonds, credit ratings, and market trends. We also offer valuable insights and analysis to help investors make informed investment decisions.

With our expertise, you can assess the creditworthiness of issuers and evaluate the risk-return profile of different bond offerings. We can analyze the financial health of the issuing company, consider the stability of its cash flows, and evaluate the potential risks associated with the bond investment.

Disclaimer: The information provided in this article is intended for general, educational, and awareness purposes only and should not be considered a comprehensive disclosure of every material fact. It should not be interpreted as investment advice for any individual or entity. The article makes no guarantees regarding the completeness or accuracy of the information and disclaims all liabilities, losses, and damages arising from the use of this information. Investments in the debt market are subject to market risk, kindly read all the documents carefully.