Introduction

Bonds and equities typically go together like peanut butter and jelly in the eyes of investors. They serve as the foundation for a well-balanced portfolio and are essential components of your long-term prosperity.

A low-key source of cash flow and capital preservation is fixed income. The bond market is also considerably more significant, but your age and risk tolerance will determine the type of fixed-income securities one should invest in.

What is Fixed Income?

Investments with a fixed income often make up a well-diversified portfolio. These are interest-bearing financial products offered by your neighbourhood bank, corporate bonds, and treasury bonds. The phrase “fixed income” refers to the regular interest payments you get when you invest. Fixed Income securities may produce a consistent stream of income that acts as a safety net for your future finances and can assist in protecting wealth.

Fixed income is a way of investing to earn regular income by investing in fixed-interest securities where you basically lend money to companies, governments, or other entities. When you invest in fixed income, you receive a set amount of interest income until the bond matures (reaches its end date), and then the principal or original investment is returned to you. Fixed-income securities are considered one of the safest fixed-income investment options because they are typically backed by the issuing entity. A fixed-income security can be issued by a government or a private company, and it can be on a short- or long-term basis.

How does the Fixed Income Market work?

Most investors who choose a fixed-income strategy want to keep their money safe. These assets offer consistent returns that follow a predetermined timetable. They will act as a source of additional money for you.

Let us understand this with an example, say XYZ Company needs capital of 100 crores for 5 years, and because XYZ has a good brand value in the market, they will issue bonds having a fixed coupon rate of 9.50% having 5-year maturity and borrow money from individuals. Over the period of the next 5 years, XYZ will pay 9.50% fixed interest p.a and on maturity, XYZ will pay the principal amount back to investors.

The most popular justification for choosing fixed-income investment is retirement. It’s a stage of life where reliable and consistent returns are crucial. A retiree may depend on income sources consistently generating the same amount each year. But the benefits of fixed-income funds are not restricted to retirees. For investors who prefer a moderate, nominal growth rate, and investors who are risk averse, fixed-income funds like bonds work as a great diversification tool to protect their portfolio from the market’s tumbling tides.

The Indian Fixed Income market can be divided into two parts- The primary market and the Secondary market. Fixed-income instruments like RBI tax-free Bonds, Sovereign Gold Bonds, etc. are directly sold to investors in the primary market. As soon as fixed-income products are issued, they are traded, that is, they are bought and sold in the secondary market. In the secondary market, brokers assist investors with the purchase and sale of fixed-income securities.

Now, how do we choose a Fixed Income Investment Plan?

Although fixed-income investment plans are less risky than other alternatives, they carry some risk. To choose the optimal fixed-income strategy for saving and investing, just follow these simple steps:

- Duration: Every fixed-income investment plan has a specified investment period, which can range from a few months to several years. Fixed-income securities maturing before 91 days are called Treasury bills and there are government-dated securities that have maturity dates of up to 40 Years! You have to pick a duration that is consistent with your financial objective.

- Liquidity: A fixed-income investment plan aims to produce a consistent income flow. However, you should also take your investment’s liquidity into account. Can you sell your investment if necessary? You should review the exit options and determine whether a penalty will result from a premature withdrawal. The plan ought to provide you with liquidity or features like a loan secured by your investment.

- Tax Savings: Consider the tax implications when comparing different types of fixed-income instruments. There are certain options like tax-free bonds, 54 EC Bonds, etc. where one can obtain tax exemption benefits. The finest fixed-income investment plans are those in which either the amount invested or the income earned is eligible for tax deductions.

- Safety: There is a certain level of risk associated with every investment and bonds are no exception. Bonds, however, are considered safe fixed-income products. In the event of a default on a secured bond, the investor is entitled to take title to the collateral first. It is important for an investor to select a fixed-income investment option that matches their risk tolerance.

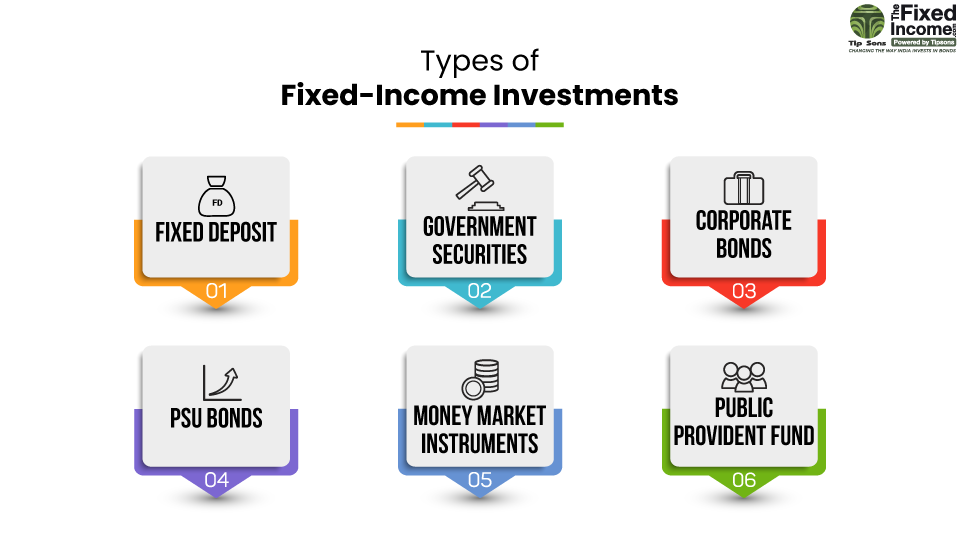

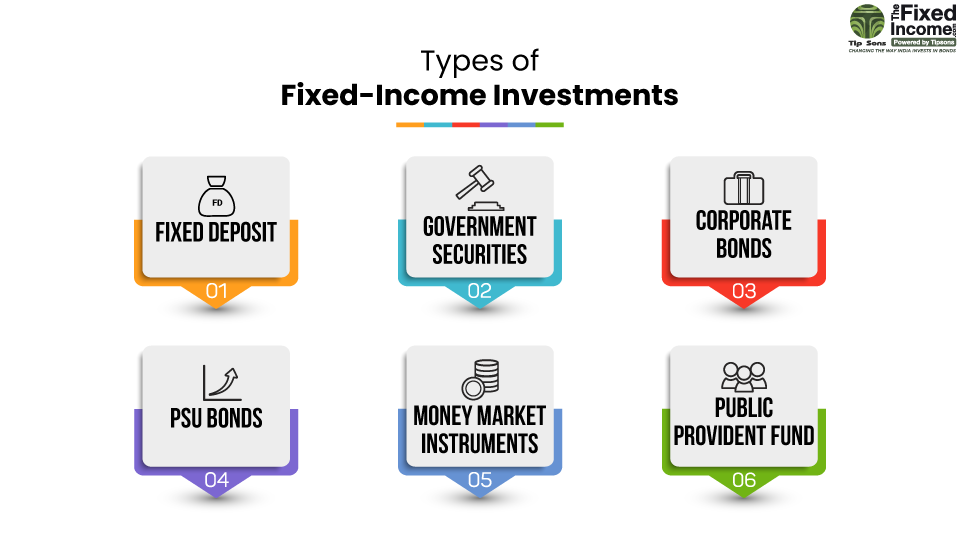

Types of Fixed-Income Investments

You have options when it comes to fixed-income investing, that much is clear. The following are some of the most conventional fixed-income investment plans:

- Fixed Deposit: One of the secure fixed-income investment options is a fixed deposit. Fixed deposits provide excellent investment tenure flexibility. The returns on fixed deposits are higher than in a savings account. Both short-term and long-term fixed deposit accounts are available. The money is secured, however, there is a penalty if it is withdrawn before the maturity time.

- State and central governments issue these fixed-income bonds which are known as government securities. Since the government issued the bonds, the risk is lower. Government Bonds are securities backed and issued by the Government of India through RBI and are of multiple tenors. It is a risk-free fixed-income investment option with negligible credit risk associated. They can be easily traded in the secondary market which makes them fairly liquid. As per new SEBI margin norms, Government bonds can be used as Cash Collateral margin/ security deposits for equity trading.

- Corporate Bonds: A corporation uses a corporate bond to raise capital from investors for a set period of time at a set interest rate. Companies raise funds for growth and expansion by issuing fixed-income bonds. The risk of a corporate bond is influenced by the issuer’s creditworthiness, the company’s financial stability, the company’s ability to repay the debt, future profitability, and revenues of the company. It is one of the excellent types of fixed-income security as it provides superior return opportunities than FDs and Government securities.

- PSU Bonds: PSU bonds, which have extremely low default risk, were issued by government-backed businesses. PSU bonds are the bonds in which the government is holding generally has more than 51% of its shareholding. PSU banks, power sector companies, railways, and other government-owned entities issue these fixed-income bonds. They are considered safe fixed-income options as government entities (central or state) issue PSU Bonds.

- Money Market Instruments: These include Treasury bills, commercial paper, certificates of deposits, etc. Money market instruments are short-term financing instruments ranging from three months to one year. T-Bills are issued by the government of India through RBI. Money market instruments are an ideal fixed-income option for investors with a minimum risk profile.

- Public Provident Fund: PPF is a fixed-income investment option with minimal risk that offers better returns than standard savings plans. The money invested is tax deductible, and the interest earned and the total amount accumulated are tax-free when withdrawn. However, the investment duration if for 15 years with an option of extending.

In a nutshell, Bonds entail some risk, like all investments, and previous performance is no guarantee of future success. But to mitigate the dangers brought on by stock market volatility and to provide a steady source of Income, the majority of investing experts advise allocating a part of your portfolio to fixed-income products like government securities, Corporate Bonds, etc.